What Are CoCos or AT1 Bonds All About?

- Eng Guan

- Mar 22, 2023

- 5 min read

Banks play a pivotal role in our system. It is not just a place for people to stash their cash away but it also ensures that money is able to move around to satisfy transactions thereby keeping our economy functioning. And when banks fail, chaos descends. You don't have to look too far back for an example. If you are at least in your late thirties now, you would have lived through the Great Financial Crisis in 2008-09 working in various capacities and have seen for yourself what happened.

Banks are required to hold regulatory capital

All banks are required by regulators to maintain a minimum level of capital against the assets they hold which are weighted by their respective risks. So different banks can have different minimum levels to meet. If a bank holds riskier assets, then it is expected to hold a higher level of regulatory capital in absolute terms. This capital act as a buffer to absorb business losses, from say bad loans, while allowing the banks to still honor withdrawal requests from depositors. And in a major event where the bank falls, it cushions against the need for using taxpayers' money in a bailout.

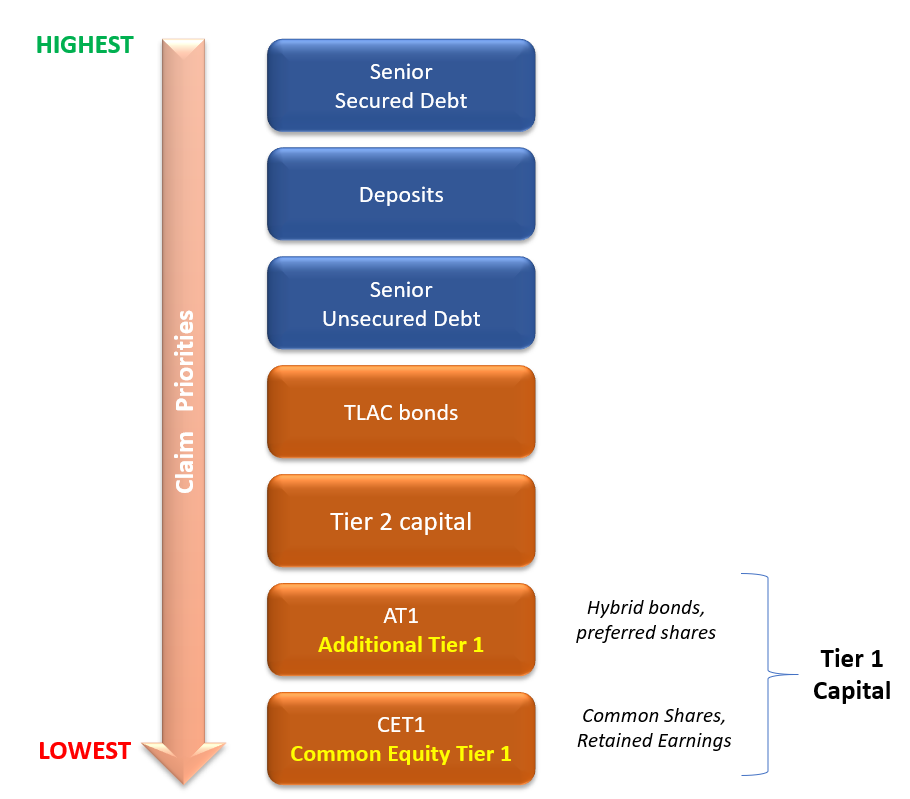

Regulators categorize a bank's capital further into different tiers and monitor them. The tiers mark the quality of the capital in terms of how reliable they are in absorbing losses. Tier 1 capital is the primary one that the market focus on. It is the first line of defense and a better indicator when it comes to measuring a bank's liquidity. And within Tier 1, it is further segregated into CET1 and AT1 capital.

CET1 represents Common Equity Tier 1 capital which includes common shares and retained earnings. This is the best and most reliable tier from the bank's and regulators' perspectives but the riskiest if you are an investor.

AT1 represents Additional Tier 1 capital and was introduced after the Great Financial Crisis to provide banks with additional avenues to raise capital to meet the heightened regulatory requirements. CoCo bonds, which are the bonds in the line of fire now, can fall under this Tier. And these CoCo bonds are also known as AT1 bonds.

What Is A CoCo Bond And How Does It Work?

CoCo (Contingent Convertible) bonds under AT1 are a type of bond issued mainly by European banks to shore up their Tier 1 capital and absorb losses for the bank (not for you) in times of extreme stress. What are its features?

Perpetual. They don't have a maturity date but they are callable.

High Yield. They pay a high coupon rate and you will understand why this is the case when you look at the rest of the features. Most lean toward the banks.

High Risk. They are risky unsecured debt structured to absorb losses for the bank. In terms of seniority or priority of claims in the event of insolvency, they only sit above equity.

Callable. The banks can call back the bonds often after 5 years on the call date but they are not obligated to do so. So theoretically, it is possible you will only receive periodic coupons and never get your principal back.

Coupon Resets. They pay a fixed coupon rate until the call date. And if the bonds are not called, the coupon resets based on a floating rate plus a credit spread.

Skip Coupon Payments. Some have features that allow the bank can to stop paying coupons when it comes under stress. And they are not required to compensate you in any way for the lost coupons in the future.

Equity Conversion Or Principal Writedown. This is the key feature behind CoCos and why they are called Contingent Convertibles. When the issuing bank faces great financial or liquidity stress that triggers certain events, these bonds can be converted to shares or written down. There are 2 types of triggers. The first is what is called a Capital Adequacy Trigger Event. This occurs when the CET1 ratio falls below a certain level. The second is called a Point of Non-Viability (PONV) trigger event which happens when regulators intervened and make the decision that this step is necessary to salvage the bank and protect the masses.

What Is The Furore About Credit Suisse's CoCo Bonds?

I will not delve into the details of what happened to Credit Suisse lately. It is all over the news and I have written something about it before as well. You can read it here.

But with respect to Credit Suisse's CoCo bonds, what happens following this episode is a PONV trigger where regulators decided to write off entirely the bonds from Credit Suisse's books. That means for these bondholders, it is "Sorry, guys, from this point onwards, we don't owe you anything now."

But the issue is that while AT1 bondholders were completely wiped out, shareholders still get compensated in terms of UBS shares. This naturally leads to a big outcry among the bondholders since this defies the well-known hierarchy of claims seniority in financial instruments. Although AT1 bonds are the riskiest type of bonds, it is still one notch above equity. So under normal circumstances, people expect shareholders to be the ones that are decimated first. But according to the banks, it was a decision made by the Swiss Financial Market Supervisory Authority (FINMA). And everything was done according to what was legally allowed under the terms of these bonds. It was clear that these bondholders are sacrificed to prevent a more catastrophic fallout.

On a better note, most retail investors are not allowed to invest directly in these CoCo bonds. They are only available to accredited investors. These are basically your mass affluents, high net worths, and institutions. So the damage would largely be borne by those who are able to take it and are deemed sophisticated enough to know what they are investing in. Having said that, retail investors can have indirect access through AT1 ETFs or mutual funds. To get a sense of where they are trading now, the Invesco AT1 Capital Bond ETF is currently down -12.85% year to date. The demand for AT1 bonds is likely to wane and banks will find it harder and more costly to raise capital going forward leading to tighter credit conditions.

But it could have been worse if the Credit Suisse saga is not contained in time and led to a more serious contagion across the globe. More banks may bite the dust. A tighter credit condition might just be that lending hand central banks need now to slow growth and fight against inflation. And this episode is also a good wake-up call to all risk-takers to bear in mind the difference between what can actually happen vs what you think should happen. Black swans are always lurking somewhere out there.

Want to know more about AllQuant?

Comments