Jim Simons holds the best trading record with his Medallion Fund. The Medallion Fund has generated nearly 70% annualized gross return since 1988. This drew a lot of interest in how he achieved this feat. A recent book by Gregory Zuckerman (The Man Who Solved the Market: How Jim Simons Launched The Quant Revolution) further fanned interest among retail investors. This led many to search for short-term high-frequency trading strategies, hoping to replicate his success.

However, what is glossed over is that the more you trade, the more trading costs you pay. There are many zero-commission brokers nowadays, but there is still the bid-ask spread that is typically wider on such platforms. Note that I have not even considered trading slippage, which is notoriously bad on zero-commission platforms. This is because they sell the order flow to third-party market makers.

You can achieve impressive performance using high-frequency trading strategies, but only if you can trade with almost no friction. And this is the true secret behind Jim Simons's success. He can negotiate favorable trading terms using the massive trading volume he directs to his brokers. He also ensures trades are executed flawlessly to minimize paying spreads. This requires resources beyond the reach of retail investors, even the rich ones.

Let me illustrate the impact of transaction costs on strategy performance using three different strategies with varying trading frequencies.

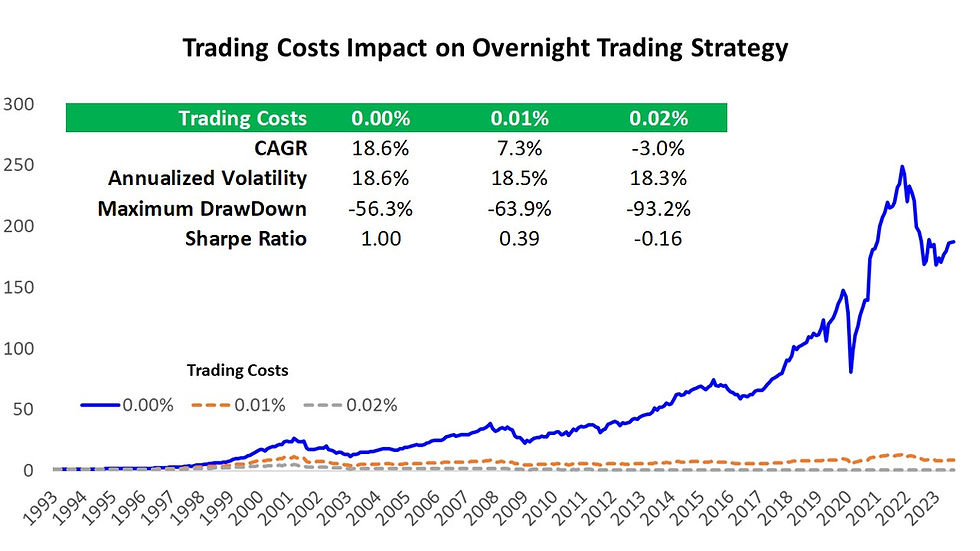

Overnight Trading Strategy (High Frequency)

We wrote about this overnight trading strategy in one of our earlier posts - Overnight Returns – Growth Happens When You Sleep. This is not a strategy we use or are even thinking of using, but I am just using it to illustrate how sensitive it is to trading costs.

This overnight trading strategy delivers decent risk-adjusted performance if there are no trading costs. However, the performance deteriorates quickly once we introduce trading costs. This is why many high-frequency trading strategies look good on paper but lose money when deployed live.

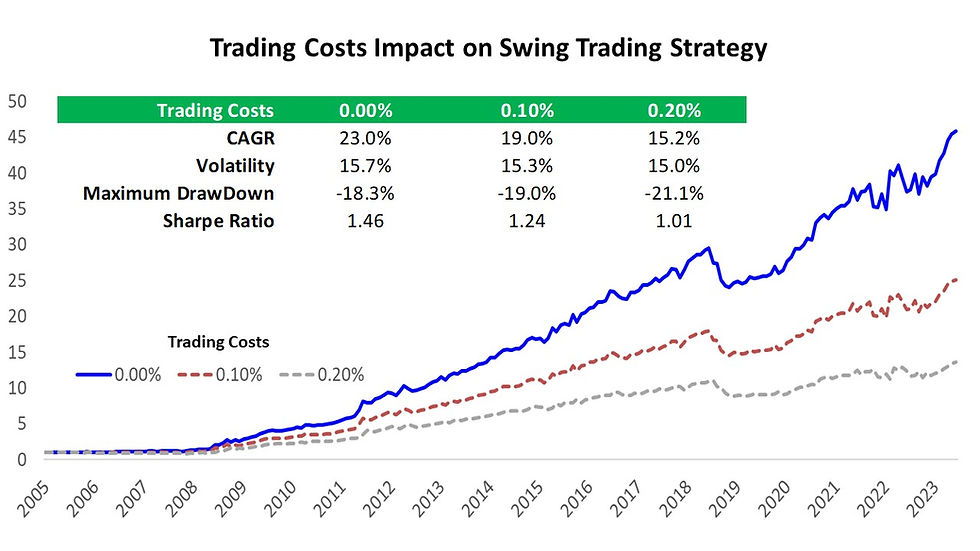

Swing Trading Strategy (Medium Frequency)

We now move on to a medium-frequency strategy using a swing trading strategy in my pipeline. This strategy can hold a position ranging from days to weeks. It can also sit on cash. It is less active than the overnight trading strategy but more active than the average long-term strategy.

This strategy is also sensitive to trading costs, but at least it can still deliver decent performance on most broker platforms.

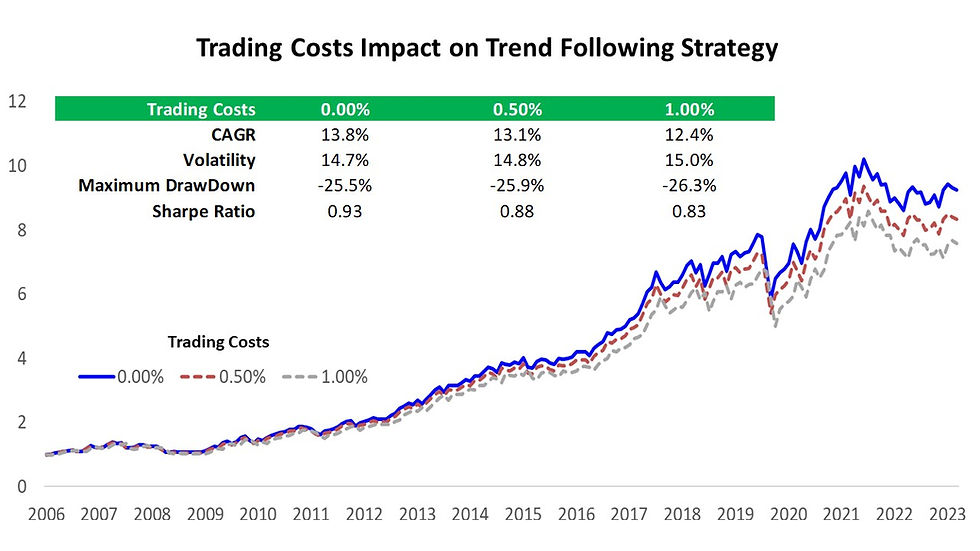

Trend Following Strategy (Low Frequency)

Finally, let me use the trend-following strategy taught in our courses to represent a low-frequency strategy. This strategy can hold stocks over months and even years if the uptrend is intact. It is much less active than the two earlier strategies.

There is little impact on the trend-following strategy, even if the trading cost is 1%. This is because there are very few trades in a year, and each trade size is a small fraction of the portfolio.

Conclusion

It is critical to pay attention to trading costs whether you are an institutional or a retail investor. The advantage institutions have is they can negotiate attractive trading terms using their large trading volumes. As retail investors, it is better to stick to longer-term strategies that do not trade so often. The performance net of trading costs may also not differ too much from higher-frequency strategies.

Let's talk more over a casual coffee session!

AllQuant uses the advanced volatility trading strategy in the multi-strategy model, capital-protected income model, and capital-protected growth model. These are developed with 30 years of joint experience across asset management, banking, proprietary trading, and hedge funds.

You can now build these portfolios through iFAST Global Markets without lifting a finger. In this collaboration, we are combining AllQuant’s expertise in hedge fund strategies and iFAST’s advisory capabilities and bringing it to your doorstep.

If you are interested in finding out more? Chat with us over a cup of coffee through a session facilitated by iFAST Senior Investment Adviser, Ou Da Wei, to find out more.

Disclaimer & Disclosure

We are not financial advisers or fund managers. The information published on this Site is provided for informational purposes only. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. Nothing on this site constitutes accounting, regulatory, tax, or other advice.

Any performance shown on this Site is model performance and is not necessarily indicative nor a guarantee of future performance. You should make your own assessment of the relevance, accuracy, and adequacy of the information contained on this Site and consult your independent advisers where necessary.

AllQuant is carrying out introducing activities for iFAST Global Markets (Singapore) as an independent entity and is NOT an agent, servant, employee, representative, or in partnership with iFAST Global Markets (Singapore). AllQuant will be receiving remuneration or introducing fees from iFAST Global Markets (Singapore).

コメント