The Fed Factor: Tracing the Impact of Fed Funds Rate on Financial Markets Since 2001 (Part 1)

- Eng Guan

- Feb 26, 2024

- 8 min read

Will the financial market collapse if the Federal Reserve tightens further?

This is one of the top concerns today. While this seemed more remote given that both the markets and the Fed have agreed, at least for now, that rates are probably going down this year, things can still change. And with memories of the damage wrecked on the financial markets when the US Federal Reserve raised the fed funds rate aggressively in 2022 still fresh on our minds, this concern is understandable.

If that scenario materializes, there are things we want to know as investors. How will the different asset classes be impacted? What will happen to stocks, bonds, REITs, and commodities? Will the same thing that happened in 2022 repeat? And how much will they fall or rise?

Most of us would prefer a definite and simple answer. For example, if the Fed raises rates by another 1%, stocks will fall this much, and bonds that much, etc. Unfortunately, things are not as straightforward as that because many other factors are at work. Even within the interest rates space, rates across different maturities may not respond in the same way.

What are Fed Funds rates?

Fed Funds rate is the rate at which banks charge each other for lending their reserve balances overnight. Using various tools at its disposal, the Federal Reserve can steer this rate toward its target range. If the Fed funds rate goes higher, that means the cost for the banks goes up and they pass it down to their clients which will eventually cascade down to everyone.

As an overnight rate, fed funds have a significant impact on short-term interest rates such as those under a year. The affected instruments will be your Treasury bills, bank fixed deposits, commercial papers, or any loans pegged to short-term rates. However, its influence on longer-term rates is far more limited. Rates on the long end are driven more by the market according to demand, supply, and expectations on how these rates will move in the future.

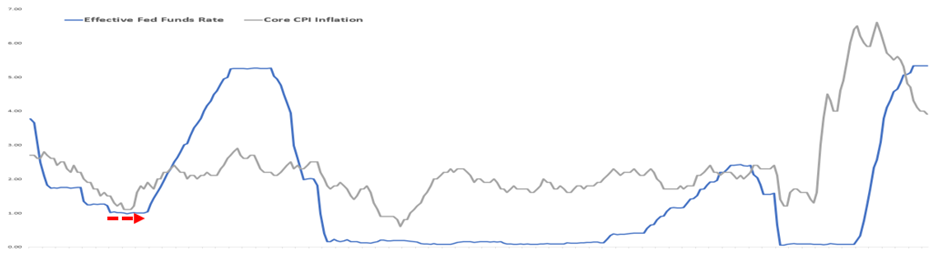

The Federal Reserve’s top function is to maintain price stability in the markets where they try to steer inflation to around 2%, a level deemed to be healthy. As the economy moves through its ups and downs, the Fed will also respond accordingly. When the economy overheats and inflation runs above or threatens to run above their threshold, they will hike the fed funds rate which raises borrowing costs to slow the economy. And if the economy is in a downturn and inflation sinks too low, they will cut the fed funds rate to stimulate growth. That is the gist of it. I know it sounds simple, just like telling you to buy when it is low and sell when it is high, but no, it is far from simple.

To get a sense of how fed funds impact the financial markets, let’s take a walk through history and see what happens during each fed fund cycle.

The Fed Fund Cycles (2001 – 2023)

Between 2001 to 2023, the US economy has been through several booms and busts. This period was selected primarily because the ETF data we used to compute the asset class performance only extended this far back. However, it is good enough to get an idea of how the markets respond during each regime.

Dot Com Crisis (July 2001 to July 2003)

We are in the midst of the Dot Com crisis. The bubble had burst in 2000, a recession was already underway, and the stock market was tanking. Inflation was falling as the economy slowed and contracted. The US Federal Reserve was in the course of cutting the Fed Funds rate to support the economy. At the end of the period, the Fed funds rates went down to 1% which was a historic low then.

However, despite the Fed's aggressive rate cuts, the stock market continued its decline, reaching its nadir only in October 2002. Why? Because the crisis had already begun and they were a step behind. No one knows how long and deep the crisis will go. Cutting too much too fast or too little too late can lead to undesirable consequences down the road. Therefore, despite all the Fed's attempts at trying to anticipate the economic trend, they usually still end up reacting rather than preempting. And this is made more challenging as monetary policy takes time to work its way into the economy.

REITs, on the other hand, performed remarkably well during the dot com crisis. While there are mitigating factors here that can support REITs such as falling interest rates and mortgages, the wide outperformance is still a surprise. Because in a downturn, real estate prices tend to decline, vacancy rates go up, and rentals are negatively impacted. But a few notable things stood out. First REITs paid a substantially higher dividend yield of around 8% back in 2000 - 2001. In contrast, a 10-year Treasury bond is only giving about 5-6% plus. Second, REITs had a bad run from 1998 – 2000 when all the attention then was on technology stocks. As a result, there may have been a shift in perception and investors started looking at REITs as a “safe haven” alternative during this crisis.

Post Dot Com Crisis (July 2001 to July 2003)

We move into the post-dot-com period where the economy is just emerging from the crisis. At least from hindsight, it is easy for us to know it is over and everything is back on track. But it is a different story if you are there then. Fed maintains the low rates for almost a year to make sure they see signs that the economy is reviving and back on track.

The recovery benefitted all asset classes in particular stocks and REITs. Note that during this period, even though the Fed funds rate has bottomed, the longer-term interest rates such as the 20-year yields continue to fall, albeit slightly. That is why TLT rose. The price of investment-grade corporate bonds represented by LQD also went higher, benefitting from the fall in interest rates as well as recovering investor sentiments.

Real Estate Boom (June 2004 to July 2006)

Post-dot-com recovery eventually turned into a period of real estate boom. Mortgage rates have dropped significantly from over 8% before the dot com hits to about 5% after the episode passed. Both the recession and the aggressive rate cuts have a part to play in that. These sow the initial seeds for the surge in real estate.

But some other things happened at the same time and carried this boom to a whole new level. At that time, financial engineering innovation was becoming immensely popular among institutions. Investment banks can package a pool of high-yielding debts into a product called CDO. The CDO is segregated into tranches marked by different yields and different risk levels. At that time, the top tranche or the safest tranche was deemed comparable against investment-grade corporate bonds in terms of credit quality, and on top of that, they offered a higher yield. Although it runs against the conventional wisdom of how a pool of subprime loans can be transformed, partially at least, into an investment-grade product, they were nevertheless highly sought after among institutions that are hunting for yields.

To create these CDOs, investment banks are willing to scoop up mortgages that provide high yields. And that led to the proliferation of subprime mortgages which tend to charge higher interest rates where lenders extend mortgage loans to borrowers with low credit ratings. Some of these borrowers did not even have an income. But the lenders don’t care because after that they will just sell these mortgage pools to the investment banks who will structure them into CDOs. As far as default risks are concerned, it no longer sits with them.

This is how subprime mortgages ended up so deeply embedded in our financial system. It also reached retail through structured products whose underlying comprises CDOs. As the economy heats up and accelerates. Fed started a rate hike cycle to contain inflation that brought the Fed funds rate from 1% to over 5%.

But even that did not dampen the sentiments. REITs enjoyed phenomenal growth during this period as the epicenter of this boom. Stocks, boosted by the economy and sentiments, also went up but paled in comparison against REITs. The behaviors of these asset classes, at least in terms of direction, are within expectations for a regime where the economy is growing with rising inflation that has not yet gotten out of hand.

What is baffling though is the behavior of bonds. Long-term yields continued to fall and bond prices rose when the Fed raised the interest rates from 1% to 5%. Given such an aggressive repositioning, most would have expected the longer-term rates to go higher even if it is just a little. Were bond markets pricing in a recession? The yield curve did turn inverted at the start of 2006.

While that is possible, it is unlikely that bond markets would expect a recession until later into this period. Based on documented posts, the fall in bond yields was attributed to heightened demand for US Treasury bonds from both foreign and domestic investors including foreign governments. This was a period where emerging countries were rapidly growing and many opted to park their funds in US Treasuries for the strength of the dollar.

Real Estate Boom Late Stage (July 2006 to July 2007)

The real estate boom finally stalled during this period. Fed maintained their rates to bring down inflationary pressures. Mortgage rates have been rising and subprime borrowers on Adjustable Rate Mortgages (ARMs) started to default on their loans. REITs run out of steam, but meanwhile, the stock market and other assets are still doing fine. Treasury yields are still falling but this time round, there is probably an element of recession being priced in.

Interim Observations

As you can see from what happened during this period, asset class behavior is shaped not just by what the Federal Reserve does. There are always other broader plays at work. While the standard prescriptions about how different asset classes behave during different types of economic regimes is still a good framework, we must keep in mind there can be deviations. For example, in the dot com crisis, REITs pretty much stood out and behaved like a safe haven even outperforming them. Then during the real estate boom that followed when Fed Funds were raised from a low of 1% to over 5% to keep inflation in check, longer-term Treasury yields dipped instead as bond prices were shored up by foreign demand.

I will end here for Part 1. In Part 2, we will take a trip back to the Great Financial Crisis which triggered a historic response from central bankers, and then see how things developed till today.

Find out ways you can invest through a coffee session!

AllQuant brings to the table a new solution for busy professionals. We put all our 30 years of joint experience across asset management, banking, proprietary trading, and hedge funds to work. And we designed an actively managed multi-strategy model portfolio that is resilient enough to weather different market conditions.

You can now build such a portfolio through iFAST Global Markets without lifting a finger. In this collaboration, we are combining AllQuant’s expertise in hedge fund strategies and iFAST’s advisory capabilities and bringing it to your doorstep.

Ready to start your investment journey? Chat with us over a cup of coffee through a session facilitated by iFAST Senior Investment Adviser, Ou Da Wei, to find out more.

Disclaimer & Disclosure

We are not financial advisers or fund managers. The information published on this Site is provided for informational purposes only. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. Nothing on this site constitutes accounting, regulatory, tax, or other advice.

Any performance shown on this Site is model performance and is not necessarily indicative nor a guarantee of future performance. You should make your own assessment of the relevance, accuracy, and adequacy of the information contained on this Site and consult your independent advisers where necessary.

AllQuant is carrying out introducing activities for iFAST Global Markets (Singapore) as an independent entity and is NOT an agent, servant, employee, representative, or in partnership with iFAST Global Markets (Singapore). AllQuant will be receiving remuneration or introducing fees from iFAST Global Markets (Singapore).

Thanks for post