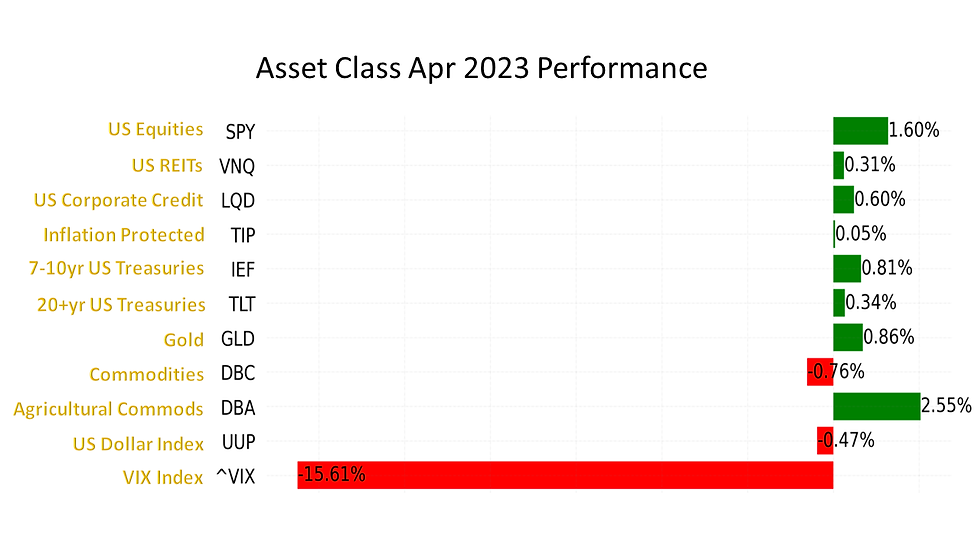

April was a dull month, with a bit of excitement towards the end when First Republic Bank went into freefall. However, other than a brief one-day knee-jerk reaction, First Republic Bank failed to bring the rest of the market down. Most asset classes ended the month close to flat. In terms of sectors, other than consumer discretionary and industrials, the rest did reasonably well.

Below is the breakdown by assets and geographies of the multi-strategy model maintained with iFAST as of April month end.

Our sizable risk exposures did well, but our volatility trading strategy was the star performer. It rode the VIX collapse all the way down. Overall, the portfolio is up 2.1% in April and 8.2% for the year.

Let's see how our retirement heroes are faring at the end of April 2023.

John, 32 years old, looking to retire in 18 years

John invested USD 40K upfront at the beginning of November 2020. He then regularly contributed USD 500 every month subsequently. As of the end of April 2023, he has contributed USD 54.5K. If he sticks to his plan, he can expect to withdraw USD 7.5K every month when he retires in 18 years without ever depleting his retirement nest egg.

Paul, 52 years old, looking to retire in 8 years

Like John, Paul invested USD 40K upfront at the beginning of November 2020. However, he knows he has a shorter runway than John to compound his portfolio. Fortunately, Paul has a higher income, so he contributes USD 4K every month to make up for the shorter runway. As of the end of April 2023, he has contributed USD 156K. If he sticks to his plan, he can expect to withdraw USD 9.5K every month when he retires in 8 years without ever depleting his retirement nest egg.

Sam, 67 years old, already retired

Sam doesn’t have any runway to compound his wealth as he is already retired. Fortunately for him, he had accumulated USD 1M of savings which he invested upfront at the beginning of November 2020. He started to draw out USD 10K every month from this portfolio. As of the end of April 2023, he has already drawn a total of USD 300K but his portfolio is still worth about USD 788K.

Outsource Investment Management

AllQuant brings to the table a new solution for busy professionals. We put all our 30 years of joint experience across asset management, banking, proprietary trading, and hedge fund to work. And we designed an actively managed multi-strategy portfolio that is resilient enough to weather different market conditions.

You can now build such a portfolio through iFAST Global Markets without lifting a finger. In this collaboration, we are combining AllQuant’s expertise in hedge fund strategies and iFAST’s advisory capabilities and bringing it to your doorstep. Ready to start your retirement journey?

Comentários