Multi-Strategy Model Portfolio Market Wrap - June 2023

- AllQuant

- Jul 1, 2023

- 3 min read

MARKET HIGHLIGHTS

The labor market continued to show exceptional strength

Despite some slowdown in manufacturing activities and reports of technology and banking sectors reducing payrolls, the overall labor market in the US maintained its robust trajectory from May. Nonfarm payrolls nearly doubled the consensus forecast. Although unemployment rose slightly, this was accompanied by more people entering the workforce. This outcome dealt another blow to those who were hoping for a rate cut by the Federal Reserve this year.

1Q 2023 GDP was way higher than forecasted or preliminary estimate

Economic data and sentiment are leaning toward the bullish side. The final GDP figure for the first quarter of 2023 came in at 2%, surpassing the forecasted 1.4% and the earlier preliminary estimate of 1.3%. Alongside a resilient labor market, a severe recession scenario now seems less likely than a few months ago.

Both headline and core PCE inflation came down more than expected

Fed's preferred inflation gauge showed that inflation slowed more than what consensus forecasted this month. Actual Core PCE was 4.6% against 4.7% forecasted while headline PCE was 3.8% vs 4.6% forecasted. This took the pressure off the markets and raises hope that the disinflationary process after a long series of rate hikes is finally taking effect after a lag.

FOMC pauses rate but signals more hikes ahead before the end of the year

The June FOMC took a pause this month without imposing any hikes. This is much in line with what the market expects. However, the meeting reveals that more members support further rate hikes before the year ends. This is a fair bit more hawkish. Prior to the meeting, the market was actually expecting one more hike followed by a cut at the end of the year. After the meeting and following all the recent market developments, the Fed Fund futures are pricing in a firm hike this July and expecting Fed to hold rates thereafter into early 2024.

Stocks have had a phenomenal run this month

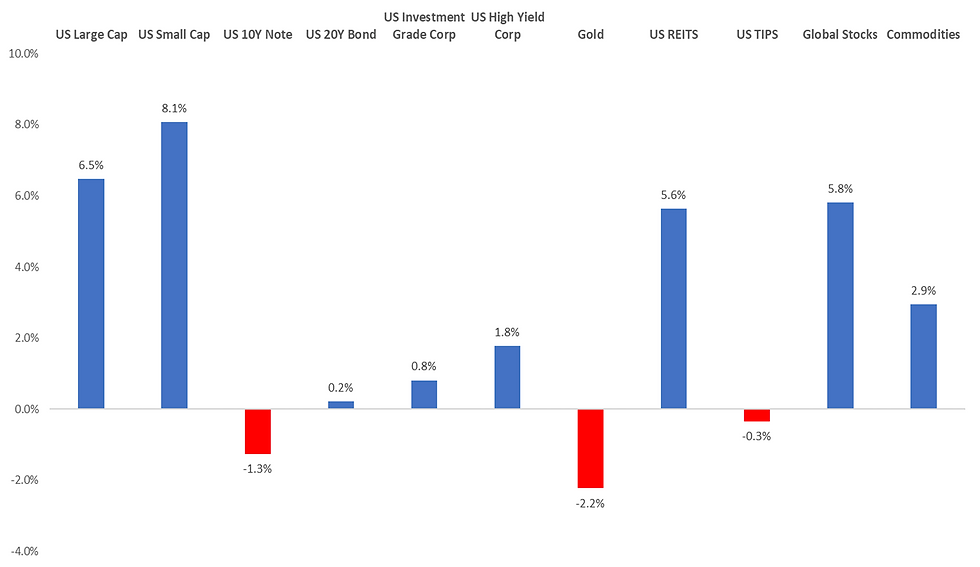

The S&P 500 surged 6.5% while small caps did even better at 8.1%. The rally was broad-based with cyclical sectors Discretionary, Industrials, and Materials taking the lead while defensive sectors lagged behind, Meanwhile, government bonds were somewhat flattish, gold dropped while corporate bonds were up with high yields ahead. These are indications of continued risk-on appetite.

MODEL PORTFOLIO UPDATES

A good month overall. Even though our model portfolio's positions in Treasuries and TIPs were flat while Gold suffered some loss, its positions in equities and short volatility more than offset these losses and helped push the portfolio further into positive territory. In particular, the model's position in the discretionary and energy sectors paid off. The model also profited from its short volatility position before sizing down and closing off the trade completely mid-month.

Overall, the model portfolio is up +3.4% for the month and +10.6% YTD.

* This is the model performance of portfolios constructed using more advanced strategies than those taught in our courses. They can be implemented with the assistance of an iFAST Global Markets (Singapore) senior investment adviser. Note that live performance may vary due to execution price slippages, the difference in sizing precisions, etc.

Want To Know More About How You Can Invest?

Our next IBF accredited course is scheduled on 24-26 July. Enrol now to learn how to extend the Modern Portfolio Theory into a multi-strategy portfolio.

Or join us for our Free Financial Education Series over a cup of coffee!

Disclaimer & Disclosure

We are not financial advisers or fund managers. The information published on this Site is provided for informational purposes only. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. Nothing on this site constitutes accounting, regulatory, tax, or other advice.

Any performance shown on this Site is model performance and is not necessarily indicative nor a guarantee of future performance. You should make your own assessment of the relevance, accuracy, and adequacy of the information contained on this Site and consult your independent advisers where necessary.

AllQuant is carrying out introducing activities for iFAST Global Markets (Singapore) as an independent entity and is NOT an agent, servant, employee, representative, or in partnership with iFAST Global Markets (Singapore). AllQuant will be receiving remuneration or introducing fees from iFAST Global Markets (Singapore).

コメント