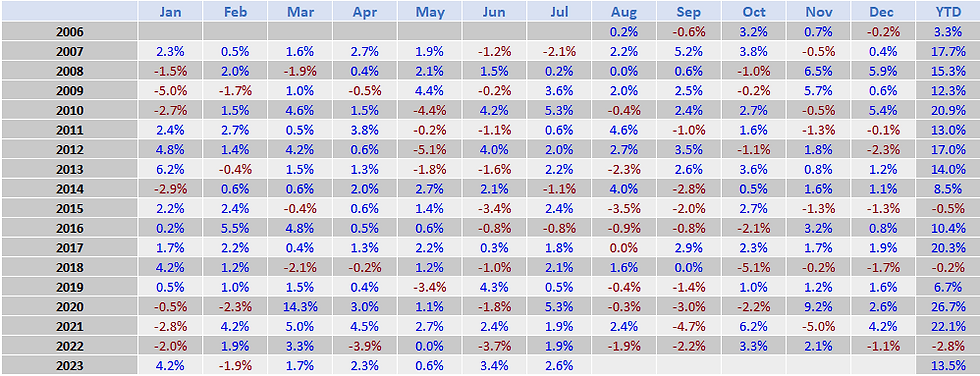

Multi-Strategy Model: July 2023 - 2.6%, YTD - 13.5%

- AllQuant

- Aug 1, 2023

- 3 min read

MARKET BRIEF

July payroll numbers came down but remained strong in the healthy range.

The month started with strong ADP employment that came in more than twice what was forecasted. That spooked the market into a selloff thinking that Non-Farm Payrolls, which is just around the corner then, would also come in way above expectations. And that will give the US Fed more reasons to keep raising rates. But as it turns out, the actual NFP figure released was below the consensus estimate. That eases the pressure off the markets. But having said that, the numbers still suggest a healthy economy with wage pressures still on the upside.

Core inflation finally budged and moved down.

Since July 2022, YoY headline CPI has been steadily moving down from a high of 9.1% to 4% before the release of June 2023 data. But over the same period, core CPI remained stubbornly high only inching down from 5.9% to 5.3%. But this month, it finally dipped more than what economists expected to 4.8%. As far as the market is concerned, that is a positive print.

The economy is more resilient than expected, Fed sounded less hawkish, but commodities are making a comeback.

With the labor market showing healthy growth, companies still reporting good earnings and a much stronger-than-expected GDP estimate for Q2, it seems the probability of a recession happening this year is becoming more remote. Fed hiked interest rates by another 0.25% this month but sounded a little less hawkish and more optimistic about the economy although they did not commit to a pause for further hikes this year. On another front, we saw commodities making a comeback since June. This will be a potential headwind against the disinflationary process and a source of headache for the Fed.

PORTFOLIO UPDATES

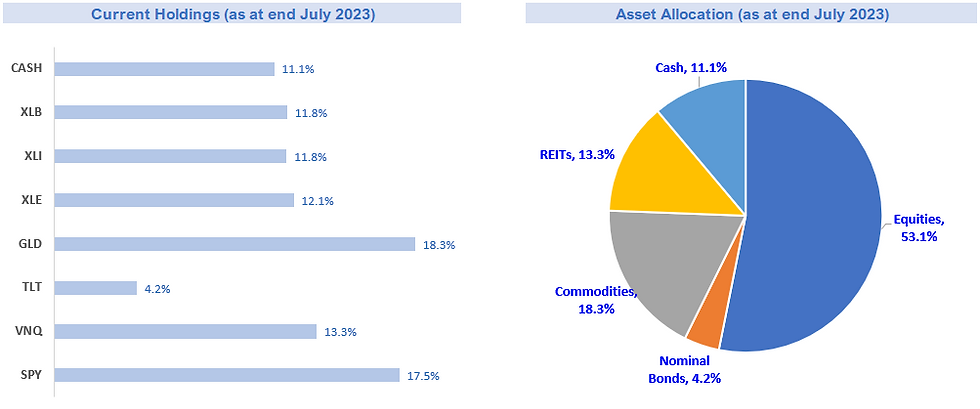

All positions held by the model were up in the green this month except for Treasuries which headed south as recession risks recedes. Gold, however, rose possibly due to the greenback retreating. The model's picks in commodity-related sectors were the top performers as a more resilient economy and stronger demand continue to drive up commodity prices.

Overall, the model is up +2.6% for the month bringing this year's return to +13.5% YTD.

* This is the model performance of portfolios constructed using more advanced strategies than those taught in our courses. They can be implemented with the assistance of an iFAST Global Markets (Singapore) senior investment adviser. Note that live performance may vary due to execution price slippages, the difference in sizing precisions, etc.

Find out ways you can invest through a coffee session!

AllQuant brings to the table a new solution for busy professionals. We put all our 30 years of joint experience across asset management, banking, proprietary trading, and hedge fund to work. And we designed an actively managed multi-strategy model portfolio that is resilient enough to weather different market conditions.

You can now build such a portfolio through iFAST Global Markets without lifting a finger. In this collaboration, we are combining AllQuant’s expertise in hedge fund strategies and iFAST’s advisory capabilities and bringing it to your doorstep.

Ready to start your investment journey? Chat with us over a cup of coffee through a session facilitated by iFAST Senior Investment Adviser, Ou Da Wei, to find out more.

Disclaimer & Disclosure

We are not financial advisers or fund managers. The information published on this Site is provided for informational purposes only. It is not intended to be, nor shall it be construed as, financial advice, an offer, or a solicitation of an offer, to buy or sell an interest in any investment product. Nothing on this site constitutes accounting, regulatory, tax, or other advice.

Any performance shown on this Site is model performance and is not necessarily indicative nor a guarantee of future performance. You should make your own assessment of the relevance, accuracy, and adequacy of the information contained on this Site and consult your independent advisers where necessary.

AllQuant is carrying out introducing activities for iFAST Global Markets (Singapore) as an independent entity and is NOT an agent, servant, employee, representative, or in partnership with iFAST Global Markets (Singapore). AllQuant will be receiving remuneration or introducing fees from iFAST Global Markets (Singapore).

Comments